Originally published at: https://blog.investengine.com/market-roundup-all-time-highs-as-q2-ends/

This week’s market roundup takes a new format! We’re pleased to introduce regular video updates, directly from our Head of Investments, Andrew Prosser.

Every Friday, Andy will be here for a comprehensive update of all the big stories in global markets.

Bang for your buck

The end of the second quarter of 2025 was broadly a positive one for markets. Headlines that declared all time highs for stocks have been slightly overblown, perhaps, given that this only applies if you look at the market priced in US dollars.

If you’re investing in Pound Sterling – which most of us are – you probably won’t be quite at an all-time high. If you’re invested in an ETF which tracks the US market, or the global market, you’re likely to still be down around 5% from the high seen in January of this year. For dollar investors, it’s been an extremely positive end to the first half of 2025.

This is because while markets have gone up, the fact that the US dollar has weakened significantly against the pound means you’re unlikely to feel the full force of that growth. For sterling investors, any weakening of the dollar means the value of dollar-denominated holdings is also weakened.

Source: Bloomberg

The difference this makes to a portfolio can be significant. In 2025, the global market is up a healthy 10.6% in dollar terms. In sterling terms, however, the growth is a more measured 1.6%. The disparity between the two is a result of the dollar’s weakness.

So, while it’s been an excellent period for markets – the market was down around 15% in April – it’s been less of a dramatic leap for sterling investors.

Fruits of US labour

In more recent news, it was also a positive week in markets.

A large driver of this positivity came out of the US, specifically after the news shared by President Trump that the US had reached a trade deal with Vietnam.

Markets have taken this deal to be a promising sign, as it opens up the possibility for further agreements before the tariff increases come into effect. Investors will be eagerly awaiting movement before the 9th July deadline in this area.

We also had another set of good news in the form of US employment data, which was released on Thursday. It showed that growth in the US labour market exceeded expectations in June – the fourth straight month this has happened.

According to the US Bureau of Labour Statistics, 147,000 new jobs were created in June, while unemployment remained stable at 4.1%. Ultimately, it showed that the US labour market continues to hold firm.

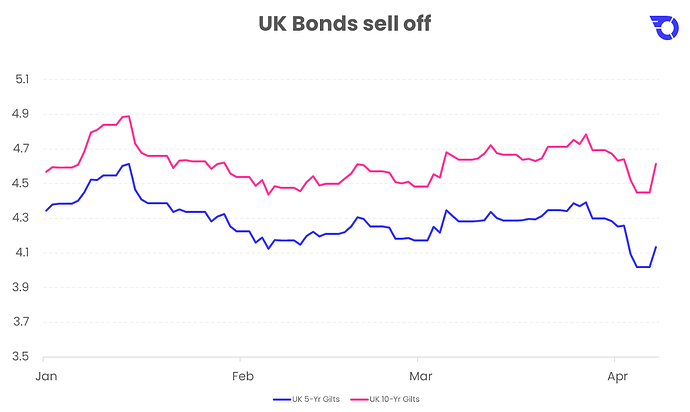

The picture was slightly less rosy in the UK, as Chancellor of the Exchequer Rachel Reeves’ future was called into question after personal issues unfortunately became public at Prime Minister’s Question on Wednesday. This led to a sell-off in UK government bonds.

Source: Bloomberg

A similar sell-off also happened in the US, but this time it was a response to the Senate passing Trump’s ‘Big Beautiful Bill’ – his tax and spending bill. This sparked major concerns about the size of the deficit, with fears of an impending debt spiral creeping in.

Important information

Capital at risk. The value of your portfolio with InvestEngine can go down as well as up and you may get back less than you invest. ETF costs also apply.

This communication is provided for general information only and should not be construed as advice. If in doubt you may wish to consult a professional adviser for guidance.

Tax treatment depends on personal circumstances and is subject to change, and past performance is not a reliable indicator of future returns.