Originally published at: Our view on the recent market turbulence – InvestEngine Insights

What’s going on right now?

It’s been a tough couple of weeks for markets.

In the US, President Trump’s tariff plans – 25% on imports from Canada and Mexico and increased duties on Chinese goods – came into effect last Tuesday. This raised the average US tariff rate to the highest level since the second World War.

The market has not viewed these tariffs as being favourable for the US’ economic outlook.

These fears escalated when President Trump, in a recent Fox News interview, didn’t dismiss the possibility of a recession, describing the current situation instead as a “period of transition.” Comments like these understandably made investors nervous. They highlight just how sensitive markets currently are to uncertainty or unexpected news.

Initially, President Trump’s policies, such as tax cuts, deregulation, and promoting energy production, were designed to stimulate growth. Tariffs were also meant to boost domestic manufacturing and job creation. It’s clear, though, that the market doubts their economic benefits.

Investors had previously relied on what’s known as the “Trump Put”. This is the idea that President Trump’s concern for the stock market would lead him to quickly reverse unpopular policies if markets dipped sharply. His recent comments suggested he might be willing to accept some market volatility, surprising investors and triggering a quick selloff.

Interestingly, though, the current selloff isn’t solely due to tariffs. Major tech companies (often called the “Magnificent 7”) operate globally and aren’t necessarily the most affected by trade issues due to their diverse operations. Their recent stock price drops indicate broader market caution and a sensitivity to any negative sentiment.

An opportunity to reevaluate your risk tolerance

Market volatility can be unsettling, so it’s a great time to revisit your personal comfort with investment risks. If recent market swings have left you uneasy about your investments, it could be a good time to revisit your risk tolerance.

After all, the current decline is yet to reach the 10% threshold to be deemed a “correction”, let alone a “bear market” (-20%) or “crash” (-30%).

Your portfolio’s asset allocation – the mix between riskier stocks and safer bonds – should match your personal goals and risk tolerance. If you’re feeling uncomfortable with the current market dip, it may be a sign you’re holding too much risk in your portfolio. A higher allocation to bonds may help you weather the storm against the inevitable larger future drawdowns.

Taking a long-term view

To maintain the long-term mindset crucial for investors, it’s useful to put the recent market drop into context.

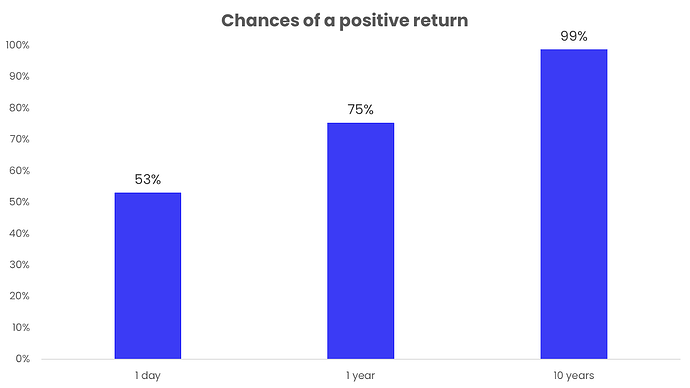

For investors worried about day-to-day market fluctuations, it’s important to remember that almost half of all trading days see the market fall. Looking back to 1970, 47% of all trading days have had negative returns. However, the longer you stay invested, the greater your chance of success.

If you hold for one day, your chances of a positive return are about 53%, based on history. But invest for a year, and your chances rise to about 75%. Invest for 10 years, and your chances are 99%. That means 99% of all 10-year periods have seen positive returns for investors.

Although the recent market dip might seem worrying, history suggests it’s completely normal for markets to experience declines of this size.

In fact, the average calendar year drawdown for sterling investors in a global equity portfolio is 14%. As our 2025 drawdown hasn’t yet reached 10%, this year’s drop is still lower than we’d expect based on historical averages.

Despite the average intra-year drawdown being 14%, the average calendar year return is still a positive 12%. This means it’s normal for markets to have a 10-20% drawdown during the year, and still finish the year in firmly positive territory. Drawdowns are the norm, and large drops don’t mean the market won’t recover.

Even more surprisingly, out of the 55 years we have data for, 31 of those years (over half) saw drawdowns of at least 10%. And of those years, the average return was still a positive 4%!

Based on this historical data, investors can expect a drawdown of at least 10% in roughly one out of every two years, at least a 20% drop in one in every five years, and at least a 30% drop every 10 years.

While this might feel worrying – market drops are always made scarier by dramatic headlines – it’s worth remembering that drawdowns are the price investors pay for higher long-term expected returns.

In fact, this is the reason equities have a higher expected return than other asset classes – stocks generate higher returns because they exhibit this kind of volatility. If the stock market wasn’t risky, investors wouldn’t receive such high returns.

What should investors consider?

To summarise, market volatility can be unsettling, making it a good time to reassess your risk tolerance and ensure your portfolio aligns with your comfort level and long-term goals.

If recent declines feel overwhelming, it may suggest that your portfolio is a little too risky – increasing bond exposure over equities could help provide stability.

However, it’s important to remember that market drops are normal and historically temporary. Nearly half of all trading days see declines, yet long-term investors have overwhelmingly seen positive returns. Staying the course through inevitable downturns is key, as volatility is the price investors pay for higher long-term gains.

Important information

Capital at risk. The value of your portfolio with InvestEngine can go down as well as up and you may get back less than you invest. ETF costs also apply.

This communication is provided for general information only and should not be construed as advice. If in doubt you may wish to consult a professional adviser for guidance.

Tax treatment depends on personal circumstances and is subject to change, and past performance is not a reliable indicator of future returns.