How does it work when I want to withdraw my SIPP from Investengine? It says that IE does not support withdrawals, is this correct? If so, what’s the point of having a SIPP with IE? Am I missing something obvious? Thanks

Good question. It was for this reason I left my pension with Vanguard, despite the higher fees.

Morning ![]()

![]()

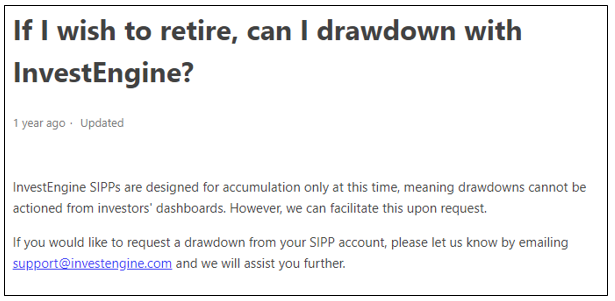

Have you seen this article?

If you will be saving into your SIPP for 20-30 years, they will probably have drawdown by the time you retire. If you are retiring this year, you will need to transfer out.

In May 2025 I was told by Client Services that “I can confirm we offer Flexi-Access Drawdown, as well as Uncrystallised Funds Pension Lump Sum (UFPLS).”

”The process involves filling of paper forms which we would prepare and send to you on request, and I can also confirm we do not charge for that service.”

paper forms?? ![]() Hope that will change in the next 10 years or so otherwise I’ll probably just transfer to one that is all done online.

Hope that will change in the next 10 years or so otherwise I’ll probably just transfer to one that is all done online.

My understanding is that the process is being done by another organisation who cannot use any of the information that IE currently holds about the owner.

As an update, the paper forms have to be printed, completed, scanned by the yourself and emailed back. Plus key documents have to be physically (in ink) certified by an official, such as a teacher. I have given-up and I am effectively doing what you suggested you would do when you retired.

Seriously? Omg what a pita and faff.

Bugger that. Will invest for some years and then transfer unless they improve their process

Thanks for the heads up

Got pensionbee and penfold Pension sipps that I can transfer to if needed

Hey maybe 212 trading get their act together and start offerings sipps

Unfortunately whilst T212 are excellent for ISA and GIA, they too have for years been promising a SIPP. In spite of the bad press I have found Freetrade SIPP to be excellent for trading in ETFs and stocks. The only issue is that like iE they are not really geared up for SIPP withdrawals and charge a high fee for each withdrawal.

My current plan for withdrawals is to do a partial transfer to a mainstream SIPP provider who will immediately do a UFPLS withdrawal. In spite of being upfront and honest with that SIPP provider they will do transfers-in for free and the withdrawals for free. So as long as I do not invest in any of their funds (which I will not because there will be no funds in that SIPP then the withdrawal process appears to be free of charge. I could not believe it but I was assured that is the case.

I nearly transferred my SIPP to Fidelity then I decided against it. Now I just think that SIPPs are set up to transfer even more of money out of your pockets.

When I turn 57 (I am currently 51), I will liquidate any SIPP holdings I have with Invest Engine (only a couple of thousand thankfully) and and Fidelity (about 40k).

I will then dump the cash into my ISA (All World Fund).

Unless you’ve got a lot of money and are a higher tax payer, then I really think SIPPs are just tools to rob you.

If your total SIPPs are around £42k then it is difficult to argue against that. The only thing I would say is that by taking out the SIPP all at once (presumably with a UFPLS) then you will suffer Income Tax (admittedly at the Basic rate) on that withdrawal. You might consider withdrawing it in stages so that you avoid even basic rate Income Tax.

My plan is very complicated but where I avoid all Income Tax until around my 80s when my ISA savings finally run out and I have to withdraw meaningful amounts from my SIPP.

Obviously if tax allowances change between now and then I will adapt my plan.

Yes, I would draw it all out in stages to avoid income tax. Fidelity do not charge for SIPP drawdown or withdrawals. If you use ETFs only then their platform fees are fixed at £7.50 a month which is very good. Invest Engine SIPPs seem to be nothing but complications.

Isn’t Gandalf also called “Gandalf the Wise”? Your comments on SIPPs (“SIPPs are just tools to rob you”) don’t seem wise at all. Please get some advice before you do anything too radical.