Yes, JPMorgan. It seems the payment date is almost a month after ex- dividend date and by that time you are on the next ex-dividend date. But I guess you still get the payment if you sell after the ex dividend date?

Well… they’re sticking strictly to the rules as set out by the London Stock Exchange.

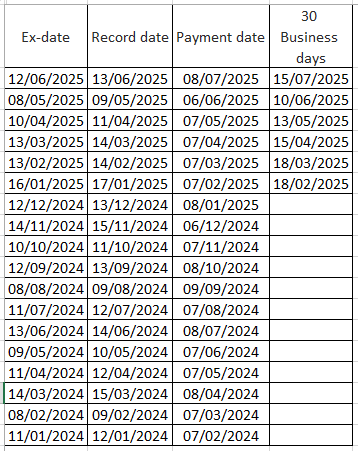

The Dividend Procedure states on page 2 that payment should be made within 30 business days after the record date. The sentence about small shareholder registers surely does not apply to JPMorgan.

With that in mind I have looked at this years dividends and it looks as if JPMorgan makes the payment within the 30 days period. That this is too close to the next Ex-Dividend Date to allow any room for delays or errors is probably not something they care about.

As for the selling bit… I would sell after the record date.

Thanks IE for listening.

14.9. Where your holding of a security entitles you to any proceeds, such as dividends in the form of cash or securities issued by way of a rights issue, upon being aware of these benefits we will allocate the benefit to your Client Account on the following day after receipt of the benefit. If the benefit takes a form that cannot be allocated to your Client Account, we may provide an alternate means of accessing the benefit or if deemed reasonable, not provide the benefit at all.

I hope that means once received it is credited the next day. If so it should hopefully avoid missing the ex-div for JP Morgan products.