Hi all,

I have the same dividend-paying ETFs with InvestEngine and another provider. I notice that with another provider, I receive dividends on the payment dates, whereas with InvestEngine, they are always delayed. Is there any particular reason for this?

Thanks you,

Sol

Hi There!

For assistance with your dividend, could you please contact our support team directly at support@investengine.com? They’ll be able to investigate this further for you.

@AbigailC , Thank you. I did approach support team and they provided the standard answer. FYI, this is not the first time that there has been a delay in dividend payments - it happened last month as well. I have requested them for a proper investigation and explanation. Hoping you can resolve this for ever.

I’m having the same issue. FTWG dividends were payed everywhere (Trading212, Freetrade, etc) except IE.

What’s the deal?

I understand it takes 5-7 days for them to process to customer’s account. Inefficient process or they might be earning interest by delaying. Either way, they should make sure that it is paid in a timely fashion. Are there any regulations around this?

More importanly, they are making us lose money

Well… it does and it doesn’t. AJ Bell credits dividends within 2 business days, Trading 212 seems to be doing it on the actual payment date, Vanguard takes a few days.

I’m not that much upset about a delay - I’m more upset about the non-communication around it.

Speaks volumes about the quality of the customer service team and how they view their jobs. Same as for all the post being made and going unnoticed and not being acknowledged for days on end.

Yeah, that’s a good point. If/when T212 finally launches SIPPs it’s going to be complicated for IE

Hi, ![]()

![]()

According to the T212 discussion boards they are now aiming to make the SIPP available at the of the current year 2025. This has been delayed since last year.

Got the dividends deposited today, so overall not that bad, one extra business day

It’s still an issue.

Last month my JEGP dividend took four days to hit my account. I emailed InvestEngine and they said it was due to the “issuers policies”. So I’ve raised a question with JP Morgan given that InvestEngine has essentially blamed them for the dividends not arriving on time. Depending on their answer I guess the next email goes to the FCA to see if I can get a straight answer.

I’m currently waiting on this months payment as well. The JEGP I have on T212 went through yesterday and my brother grabbed some JEGP at Barclays, to see how long they take to pay out dividends and he said it hit account yesterday.

If there is a really good reason why they aren’t hitting the account on the day of payment, be up front about it. That’s all I want. Fobbing me off with a generic message that explains nothing is going to push me to keep asking people until a real answer is forthcoming.

Does it really matter? Providing you get the dividend, I don’t see the issue.

I say this as someone who receives vanguard distributions faster on non-vanguard platforms than on Vanguard, and I’ve just never thought to complain about this as if it is a meaningful issue that needs addressing or that I’m owed some answer to.

Well yes it actually does, both from a financial law aspect and in general. You get paid dividends and that money should be instantly sent to your account. If it isn’t, then where is it, who is gaining interest on it, why hasn’t it been sent to your account. As someone in the IT sector, I just don’t understand how it can take so long. If I move money from an account to another account it takes a msec to do. A dividend payment is simply money with a unique reference attached to it. To parse the reference number and credit to an account should take no longer than a bank transfer. It should be a completely automated system. If T212, Barclays and so many others can do it instantly, why can’t all do it instantly?

My question is specifically why is it taking so long? If they come up with a specific answer and not some generic “blame it on everyone else” answer, i’d be totally fine with that. If they said it takes two days to hit your account because we want to get two days of interest out of that money, i’d also be fine with that answer (it’s a free platform and they have to make their money somewhere). If they said “we have a crap computer system from the early 2000’s that can’t process things quickly”, i’d also be fine with that, although would consider it worrying given how cheap a computer is nowadays. But it’s the generic, fob you off, answer that irks me. Be upfront about things and most people will appreciate the honesty. Throw out some generic BS and people will not.

Apart from losing interest, there is also a loss by not being able to reinvest instantly for those who reinvest dividends.

Morning ![]()

![]()

I don’t hold JEGP so cannot say anything about this but one of my dividends within Vanguard is currently taking longer than usual to be credited.

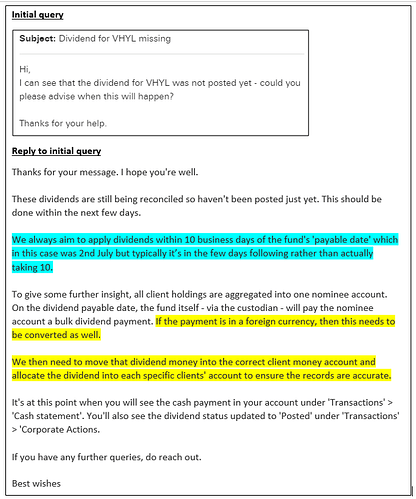

I have messaged CS and this was the reply:

The section in blue is written into the T’s and C’s of Vanguard - by opening an account one agrees to this. In case of queries - this can easily be found on their website - so if there are any delays then one knows to allow 10 business days = 2 weeks.

The section in yellow explains what happens when Vanguard receives dividends. Converting money between currencies is nice ‘n’ easy and moving money is easy as well as all done by computers and no office boy hauling gold bars through London town. ![]()

Atm, Vanguard UK has over 600,000 customers so moving the money into customer accounts and making sure everything went okay will take some time - and we’re looking at hours/days rather than minutes depending on how they process transactions.

I had more than 1 dividend-paying holding and some of the other dividends had been credited within a couple of days. Also, Vanguard had recently changed their fees for account with balances of less than £32K … so I followed up on the reply.

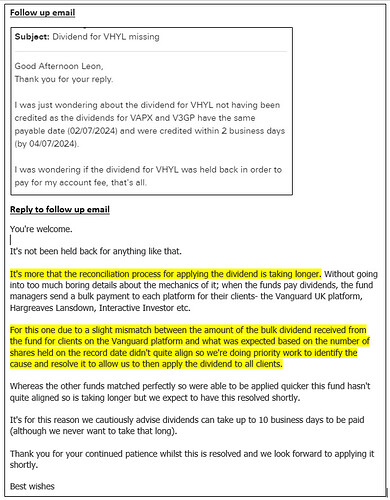

The section highlighted in yellow contains the for me interesting part - an insight into what’s happening behind the scenes. Reconciling accounts is slow work… but as we’re still within the aforementioned period of 10 business days - I’m not even going to look at it again until Friday next week. The dividend is high enough to buy new shares on Autoinvest anyways.

As of right now the missing dividend has still not been credited. I only hold ETF’s in Vanguard and they don’t do fractional shares for ETF’s.

So, maybe this is what’s happening with JEGP in IE as well?

As I’ve said further up in the thread - I’m not that much upset about a delay in general - I’m more upset about the non-communication around it. Although I do want the money, obvs, ![]() as I’d like to reinvest it before the next monthly ex-dividend date.

as I’d like to reinvest it before the next monthly ex-dividend date.

Also, if as a business you have these kind of issues it would be way easier to be proactive rather than reactive. Putting up a post on these ‘ere boards telling us about delays surely is faster and easier than having to reply to lots of people separately when they start contacting CS about missing payments, methinhks. Jus’ sayin’

The dividend payment dates for XYLP and QYLP were today, and I have already received them in Trading 212. As usual, nothing in InvestEngine yet, but based on past experience, I expect to recieve in 3-5 days- possibly Wed/Thu.

Me too and they have already been reinvested automatically. ![]()

The ex-div is the main issue. For JEGP payment date is around the 7th of the month and the ex-div for the next month is 3-5 days later. So if the dividend doesn’t arrive within say 2 days, I lose money.

So for example, this month i am pretty sure I’ve lost money by the dividend not arriving on time. If you consult the ex-div data for JEGP on dividenddata, you’ll see the dividend is paid on the 8th of July and the ex-div was the 10th.

I think I will probably have to sell off my portfolio on IE and move it to T212 because I find it unacceptable to continually lose money because divs aren’t arriving on time and by that happening missing the ex-div for the next month. But I can’t do anything about the SIPP. I will accept that until I can find somewhere.

@Pinch I honestly find what Vanguard says to be very unacceptable. it’s not like they are a small company, like IE. They are a major player. Having 600,000 customers is not an excuse when you are that big of a company. Would you put up with it if your monthly wages took a week to arrive in your bank account and your bank said it was because they had a lot of customers? Same thing.

For me if I didn’t keep missing the ex-div, I wouldn’t care, but each time I miss it, I lose money and that does irk me a fair bit. But what can you do I guess, except liquidate the portfolio and move it elsewhere.

@PF75, It seems the ex-dividend dates is an issue with other JPMorgan funds like JEQP and JEIP as well. Wondeing if this is a strategy to lock investors?!

Do you mean if this is a strategy from JPMorgan? If it is then it’s maybe not the best strategy, methinks. They are the ones setting the dividend dates after all.